27 July 2019 by Oladeinde Olawoyin (former Money Trail trainee London 2018)

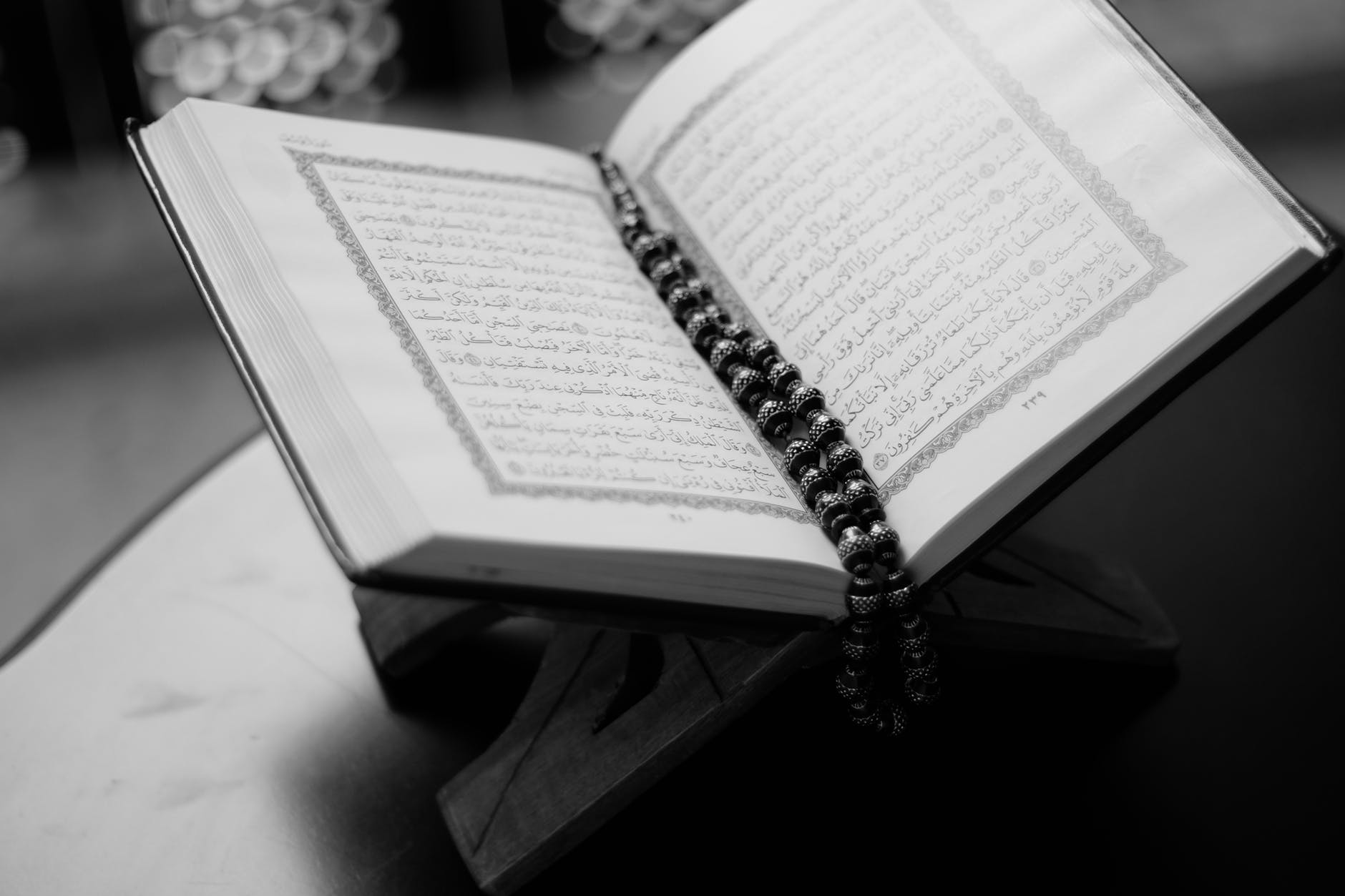

The Islamic finance sector has grown noticeably over the years, from about $1.5 trillion in 2016, to about $2 trillion in 2018, driven by growth in Islamic banking asset as well as growth in Sukuk issuances on the stock market. Mrs Largarde, former IMF boss, noted in 2015 that Islamic finance has the potential to contribute to higher and more inclusive economic growth by increasing access to banking services to underserved populations. Despite the huge potential of Islamic finance products in the larger Nigerian economy, challenges include regulatory and tax issues; issues around Sharia scholars and Sharia-compliant products; as well as the dearth of knowledge on Islamic finance products. In September 2017, shortly after the Nigerian government introduced its debut Sukuk offer, the Christian Association of Nigeria (CAN) said the move was part of the “strategies to ‘Islamise’ Nigeria”.

Please read the full article on Premium Times Nigeria here